Insulin Pump Market Insights $2.1B Revenue from Insulet, 500,000+ U.S. Users and 47.8% Adoption in Canada Driven by Government Funding

This report provides an in-depth analysis of the insulin pump market, highlighting key trends in pricing, manufacturing, and sales growth from 2020 to 2035. It is published by a sister firm of Precedence Research, focusing on advancements in healthcare technologies and their impact on diabetes management.

Ottawa, Feb. 06, 2026 (GLOBE NEWSWIRE) --

Over the past few years, the insulin pump market has experienced impressive growth, thanks to improvements in diabetes management technology and the rising number of people affected by diabetes. Insulin pumps, which offer a more consistent and accurate way to deliver insulin, have become essential for many living with Type 1 and Type 2 diabetes. As the market evolves, it’s important to understand how insulin pumps are priced, how they’re manufactured, and how sales are projected to grow. In this article, we’ll explore these key aspects, breaking down the expected sales volume, manufacturing costs, and price ranges from 2020 to 2035. By looking at these trends, we’ll get a clearer picture of where the insulin pump industry is headed and its growing role in diabetes

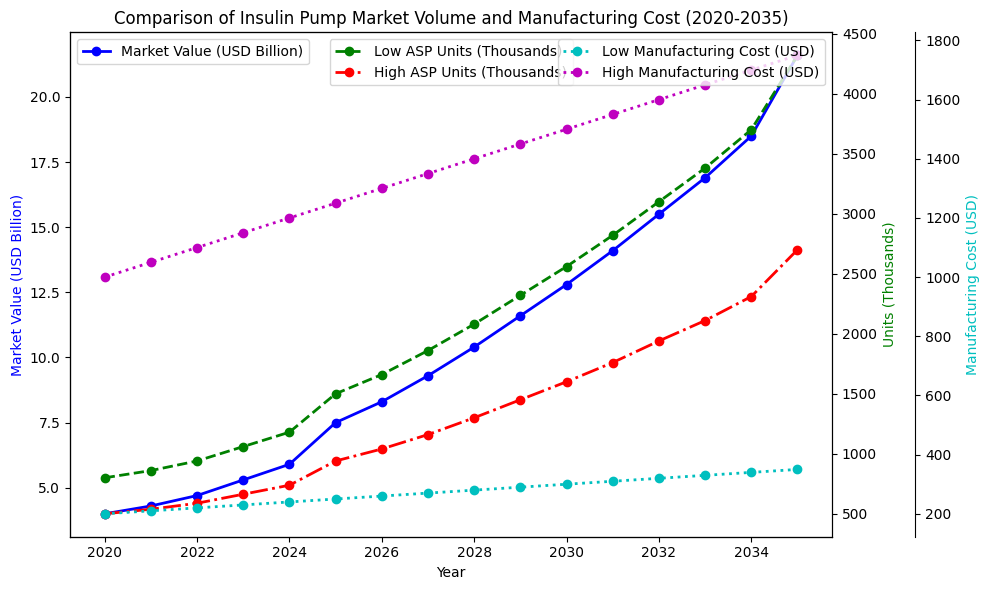

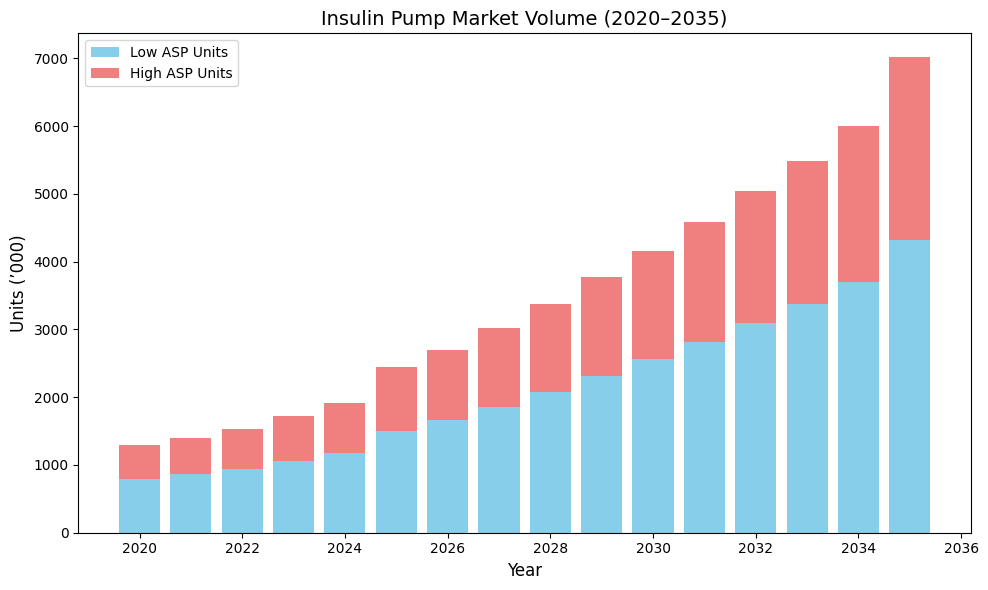

Insulin Pump Market Volume Table (2020–2035)

| Year | Market Value (USD Bn) | Low ASP Units (‘000) | High ASP Units (‘000) |

| 2020 | 4 | 800 | 500 |

| 2021 | 4.3 | 860 | 538 |

| 2022 | 4.7 | 940 | 588 |

| 2023 | 5.3 | 1060 | 663 |

| 2024 | 5.9 | 1180 | 738 |

| 2025 | 7.5 | 1500 | 940 |

| 2026 | 8.3 | 1660 | 1040 |

| 2027 | 9.3 | 1860 | 1160 |

| 2028 | 10.4 | 2080 | 1300 |

| 2029 | 11.6 | 2320 | 1450 |

| 2030 | 12.8 | 2560 | 1600 |

| 2031 | 14.1 | 2820 | 1760 |

| 2032 | 15.5 | 3100 | 1940 |

| 2033 | 16.9 | 3380 | 2110 |

| 2034 | 18.5 | 3700 | 2310 |

| 2035 | 21.6 | 4320 | 2700 |

The volume table shows how many insulin pumps are expected to be sold globally each year, from 2020 to 2035. The sales volume is projected based on how much the insulin pumps cost on average. For example, if an insulin pump costs around $6,000 on average and the market value is $7.5 billion, we estimate around 1.5 million pumps are sold in that year. Over the next decade, as the market grows, more pumps are expected to be sold, with the market growing at a healthy pace.

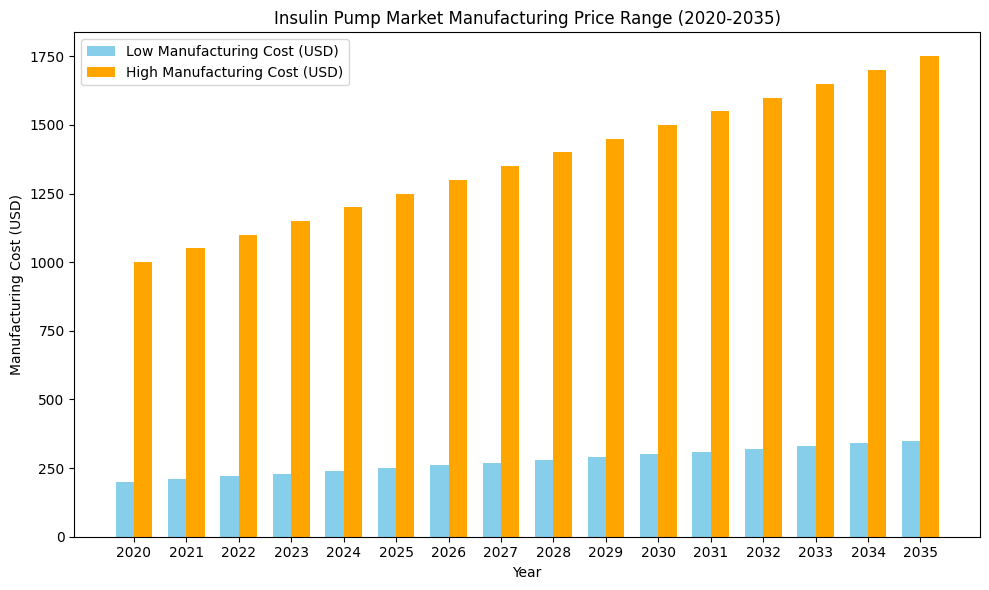

Insulin Pump Market Manufacturing Price Range Table (2020–2035)

| Year | Low Mfg Cost (USD) | High Mfg Cost (USD) |

| 2020 | 200 | 1000 |

| 2021 | 210 | 1050 |

| 2022 | 220 | 1100 |

| 2023 | 230 | 1150 |

| 2024 | 240 | 1200 |

| 2025 | 250 | 1250 |

| 2026 | 260 | 1300 |

| 2027 | 270 | 1350 |

| 2028 | 280 | 1400 |

| 2029 | 290 | 1450 |

| 2030 | 300 | 1500 |

| 2031 | 310 | 1550 |

| 2032 | 320 | 1600 |

| 2033 | 330 | 1650 |

| 2034 | 340 | 1700 |

| 2035 | 350 | 1750 |

Manufacturing cost refers to what it takes to actually build an insulin pump, including the parts and labor required. The table shows the expected low cost for basic models and the high cost for advanced models. For example, a basic insulin pump might cost around $250 to manufacture, while a high-end model could cost up to $1,750. These values gradually increase over time because of inflation, technology upgrades, and better safety features.

Customize your insulin pump market report with detailed insights, including company revenues, adoption rates, and government reimbursement data, tailored to your specific needs and region @ https://www.towardshealthcare.com/download-sample/5025

Leading Players in the Insulin Pump Industry

Several companies dominate the insulin pump market, each with significant revenues tied to the sale of insulin pumps and related technologies. Let’s explore the financials and operational data of the leading players in the market:

Insulet Corporation

- Revenue: In 2024, Insulet Corporation reported a total revenue of $2.1 billion, with $2.0 billion coming from its flagship insulin pump product, Omnipod.

- Segmental Sales: U.S. sales accounted for $1.5 billion, while international sales stood at $523.4 million.

- Growth: Insulet’s revenue increased by 22.1% year-over-year (YoY) in 2024, showcasing the growing demand for its insulin pumps.

Medtronic Plc (Diabetes Division)

- Revenue: Medtronic's diabetes device segment, which includes insulin pumps, generated $694 million in one quarter, highlighting the significant role diabetes products play within the company's portfolio.

- Growth: Medtronic's diabetes business overall grew by 10.7%, contributing to an overall sales figure of around $2.8 billion for diabetes devices in the last fiscal year.

- Integration: Medtronic integrates insulin pumps with continuous glucose monitoring (CGM) systems, enhancing the overall management of diabetes.

Ypsomed Holding

- Revenue: Ypsomed, a Swiss-based company, generated CHF 728.9 million ($928 million) in total annual revenue in 2025, which includes sales of insulin infusion systems and other self-medication devices.

- Market Position: As a leader in diabetes self-management devices, Ypsomed serves a global market with a focus on high-quality infusion technology.

Tandem Diabetes Care

- Revenue: In 2019, Tandem Diabetes Care reported a revenue of approximately $362 million, primarily driven by its t:slim insulin pumps.

- Growth: Tandem’s innovative pumps are helping to capture significant market share in the insulin pump sector.

Medical Industries

- Revenue: In 2011, D. Medical Industries reported a revenue of $0.39 million, highlighting its focus on smaller-scale, niche segments of the insulin pump market.

- Product Range: D. Medical offers insulin pumps through its subsidiary, Spring-Set, contributing to the wider range of available pumps.

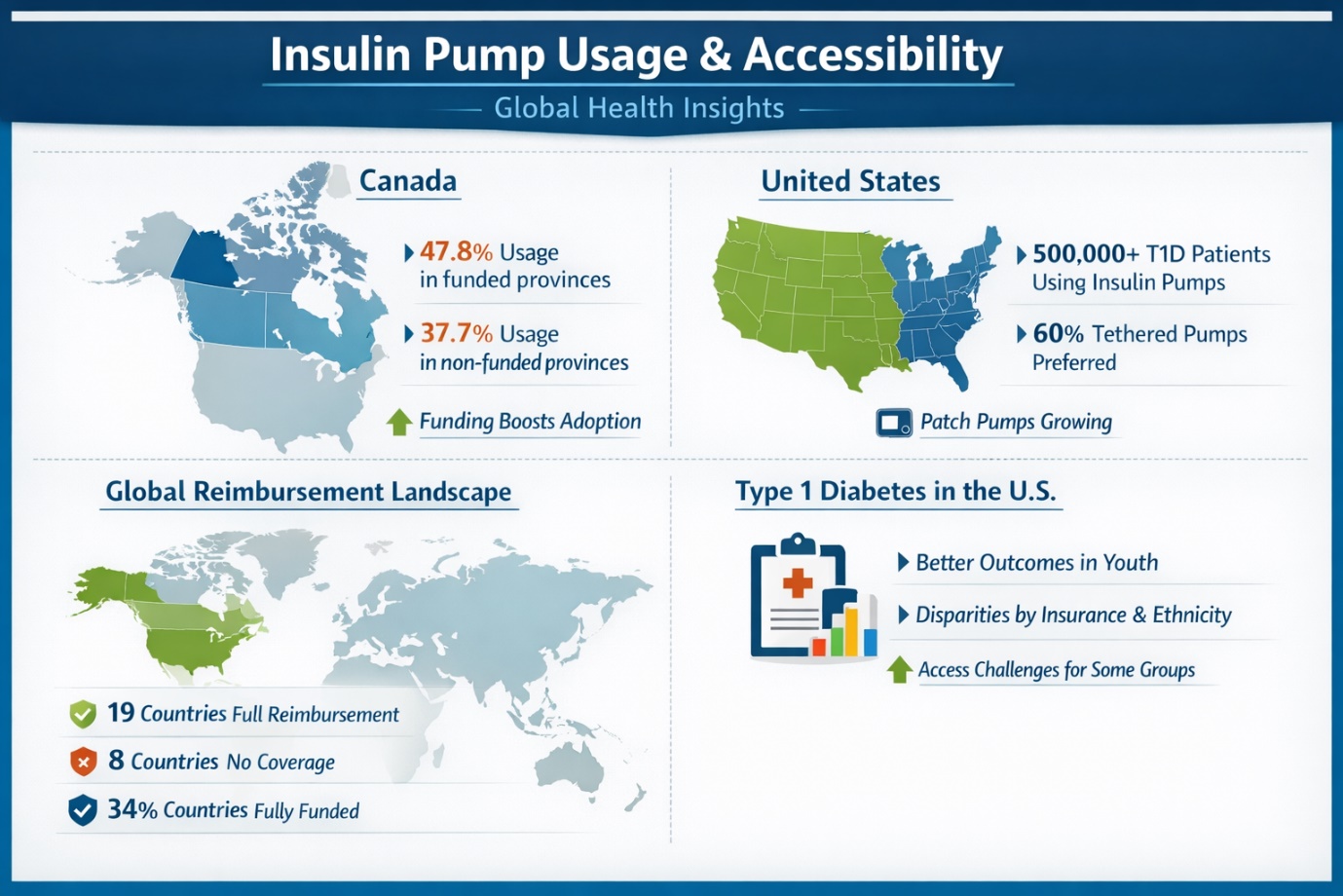

Government and Health Authority Insights: Insulin Pump Usage and Accessibility

Beyond company data, government and health authority reports offer valuable insights into how insulin pumps are being adopted and reimbursed globally. These figures often reflect broader trends in diabetes care, accessibility to medical technology, and the evolution of healthcare reimbursement policies.

Canada

- Usage: In provinces with government funding for insulin pumps, 47.8% of eligible patients used insulin pumps, while in provinces without funding, only 37.7% of patients used pumps.

- Impact of Funding: Government funding has a significant influence on insulin pump usage, with higher adoption rates observed in provinces offering reimbursement.

United States

- Usage: In the U.S., it is estimated that over 500,000 people with type 1 diabetes use insulin pumps, with a higher adoption rate for tethered insulin pumps (60%).

- Patch Pumps: While patch pumps are growing in popularity, they still make up a smaller portion of the market.

Global Reimbursement Landscape

- Reimbursement Availability: A global survey across 56 countries revealed that 19 countries (34%) offer full reimbursement for insulin pumps, which influences their accessibility.

- Countries without Coverage: 8 countries have no reimbursement for insulin pumps, limiting access to these critical devices for diabetes patients.

Type 1 Diabetes Usage Trends in the U.S.

- Adoption and Outcomes: The T1D Exchange quality improvement data shows that insulin pump usage is associated with better clinical outcomes, particularly in younger age groups.

- Disparities: Usage rates vary by insurance coverage, ethnicity, and age, with some groups facing barriers to adoption despite the proven clinical benefits of insulin pumps.

Key Insights and Observations

Company Insights:

- Insulin pump manufacturers like Insulet and Medtronic are experiencing significant growth, with Insulet being a standout performer with its Omnipod system contributing over 95% of its revenue.

- Medtronic, while a dominant player in diabetes management, faces competition from newer, more specialized companies like Tandem Diabetes Care.

Government Insights:

- The adoption of insulin pumps is heavily influenced by government reimbursement policies, with countries offering full reimbursement seeing higher usage rates. In contrast, many countries around the world still lack sufficient reimbursement, limiting access to these devices.

- The U.S. and Canada show high insulin pump adoption, but the figures also reveal disparities in access based on socioeconomic factors.

Insulin Pump Market Forecast and Analysis (2026-2035)

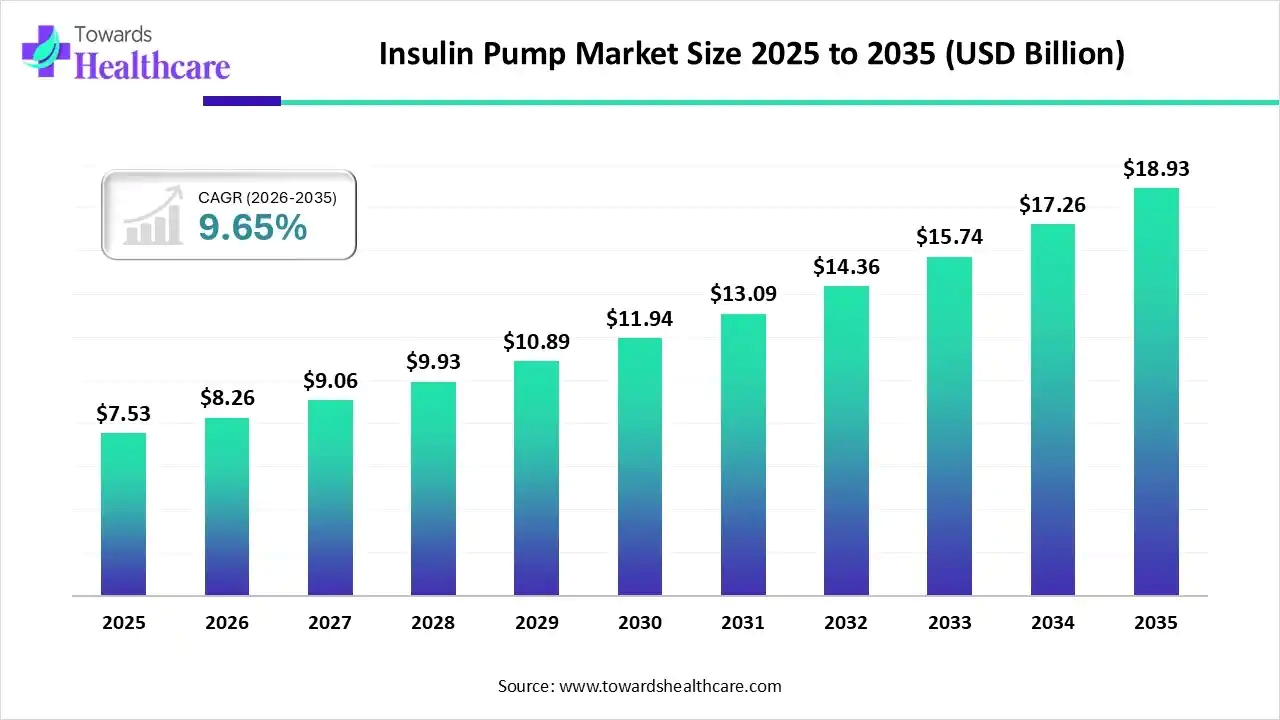

The insulin pump market is forecast to grow at a CAGR of 9.65%, from USD 7.53 billion in 2025 to USD 18.93 billion by 2035, over the forecast period from 2026 to 2035. The market is expected to gain traction owing to industry players focus on the launch of technologically advanced CGM and insulin pumps.

Unlock tailored insights and solutions for your business with our customized insulin pump market report: https://www.towardshealthcare.com/checkout/5025

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.