U.S. Healthcare RCM Market Climbs to $195.92 Billion by 2035 as Digital Adoption Accelerates

The U.S. healthcare revenue cycle management market size is calculated at USD 72.96 billion in 2026 and is expected to reach around USD 195.92 billion by 2035, growing at a CAGR of 11.6% for the forecasted period.

Ottawa, Nov. 24, 2025 (GLOBE NEWSWIRE) -- The U.S. healthcare revenue cycle management market size was valued at USD 65.38 billion in 2025 and is predicted to hit around USD 195.92 billion by 2035, rising at a 11.6% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is rising because escalating healthcare costs, increasing regulatory and reimbursement complexity, and the drive for digital efficiency are all compelling providers and payers to adopt advanced revenue cycle management (RCM) solutions.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6284

Key Takeaways:

- U.S. healthcare revenue cycle management sector pushed the market to USD 58.56 billion by 2024.

- Long-term projections show USD 171.97 billion valuation by 2034.

- Growth is expected at a steady CAGR of 11.6% in between 2025 to 2034.

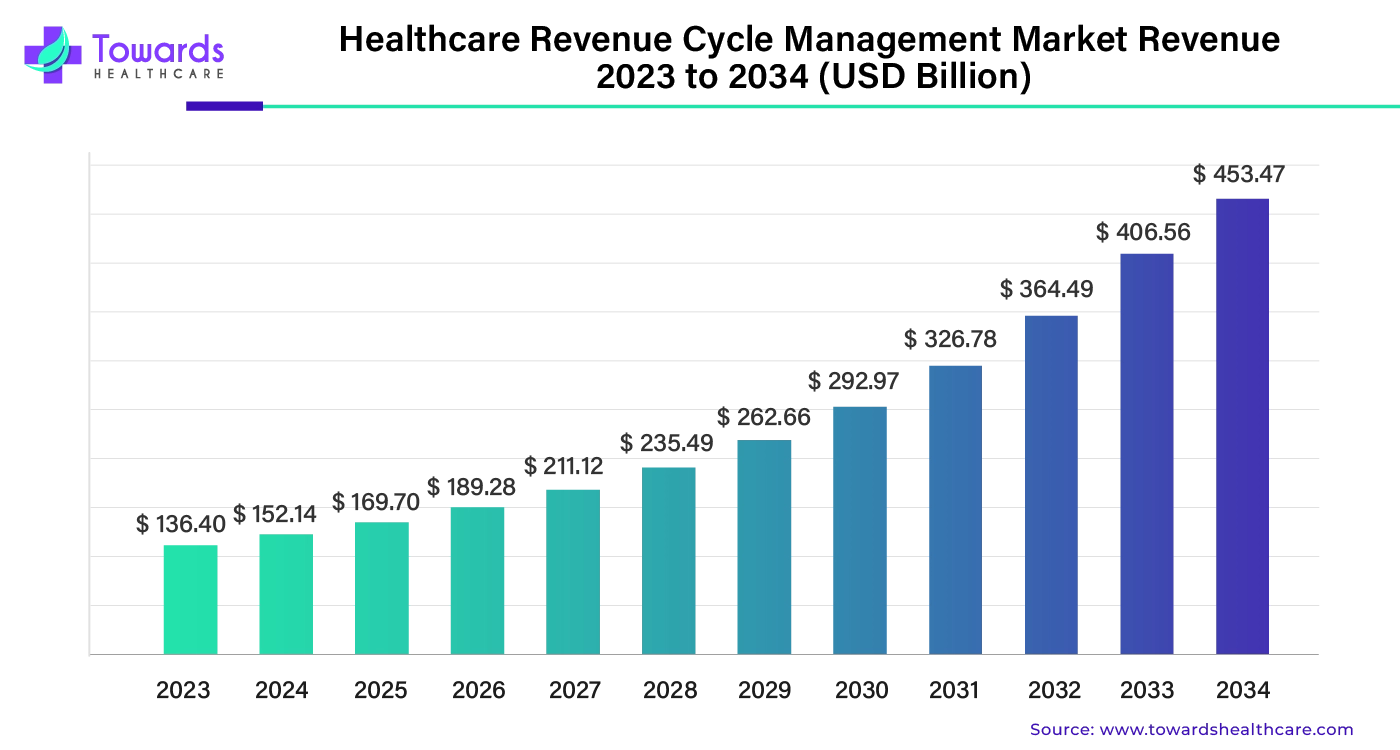

- The global healthcare revenue cycle management market is set to grow from US$136.40 billion in 2023 to US$453.47 billion by 2034 at a CAGR of 11.54%.

- By product type, the integrated segment dominated the U.S. healthcare revenue cycle management market in 2024 and is expected to grow at the fastest CAGR during the forecast period.

- By function type, the claims & denial management segment dominated the market in 2024.

- By function type, the medical coding & billing segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment type, the cloud-based segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period.

- By end-user, the physician office segment dominated the U.S. healthcare revenue cycle management market in 2024.

- By end-user, the hospitals segment is expected to grow at the fastest CAGR during the forecast period.

Market Overview:

What Factors are Driving Growth in the U.S. Healthcare Revenue Cycle Management Market?

U.S. healthcare revenue cycle management (RCM) market is experiencing significant growth as healthcare organizations strive to optimize financial workflows in the midst of rising overheads and tighter margins. A blend of digital transformation and the need to reduce claim denials, combined with continued staffing shortages in billing/coding, and regulatory requirements is driving healthcare organizations to adopt RCM platforms across hospitals, physician practices and other healthcare providers. Healthcare organizations are increasingly replacing disjointed legacy systems with integrated, cloud-native, automated RCM to improve revenue capture, reduce the number of days-in-accounts-receivable and improve operational transparency.

Quick Facts Table

| Table | Scope | |

| Market Size in 2025 | USD 65.38 Billion | |

| Projected Market Size in 2035 | USD 195.92 Billion | |

| CAGR (2026 - 2035) | 11.6 | % |

| Market Segmentation | By Product Type, By Function Type, By Deployment Type, By End-user | |

| Top Key Players | Optum, Oracle Cerner, Epic Systems Corporation, R1 RCM, McKesson Corporation, Waystar, Athenahealth, Conifer Health Solutions, Experian Health, The SSI Group, eClinicalWorks, FinThrive Revenue Systems, Ensemble Health Partners, NextGen Healthcare, AdvantEdge Healthcare Solutions, GeBBS Healthcare Solutions, Huron Consulting Group, Cognizant, MedEvolve, CareCloud | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What Principal Factors are Advancing the U.S. Healthcare Revenue Cycle Management Market?

- The complexity of reimbursement and billing: Provider organisations are resorting to advanced RCM platforms for pre-service financial clearance, claim submissions and post-service collections due to increasingly complex payor rules, rising denial rates and value-based care contracts.

- Digital and cloud adoption: With the shift from on-premises legacy systems to cloud-based, integrated RCM solutions the demand for scalable, cost-effective solutions that support interoperability, analytics and automation is positively impacting the market.

- Workforce pressure and cost optimisation: The demand for revenue cycle management (RCM) solutions with automation, AI-assisted medical coding and denial management help relieve the pressure on healthcare providers to reduce administrative labour costs, reduce coding/billing mistakes and manage staffing shortfalls in revenue cycle departments.

- The growth of outsourcing and service models: The service side of the market is also growing as many smaller physician practices and ambulatory providers utilize outsourced RCM services or a managed-services model to tap into enterprise-grade revenue cycle capabilities without incurring large expenses upfront.

Key Drifts:

How Does Emergence of Cloud Platforms Create Potential for Healthcare Revenue Cycle Management Market?

One notable trend is the transition away from standalone, point-tools and toward integrated RCM platforms that facilitate workflows across registration, eligibility verification, coding, billing, denial management, and analytics. Additionally, the emergence of cloud-based deployment is transforming how providers engage with RCM, allowing them to scale up more, accelerate time to value, and establish remote staffing. RCM trends also include automation and the emergence of AI-enabled functionality in areas like medical coding, billing, claim denial prevention, and analytics. Collectively, these trends are reinforcing the shift from a reactive approach to claims to a proactive approach to revenue optimisation and intelligent workflow orchestration.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

While there is evident momentum in the marketplace, the operational and integration burden of implementing advanced RCM systems remains a significant challenge. Many healthcare organisations have siloed legacy systems, variable data quality, interoperability gaps between EHR and billing platforms, and workforce change-management challenges. These challenges collectively slow down the realisation of ROI, impact user adoption, and (even) extend the revenue cycle versus compressing it. As one report identified, only about 31% of smaller practices build structured onboarding time for the utilisation of new RCM software in other words, they expect a degree of adoption without a structured approach to onboarding.

Regional Analysis:

The U.S. Healthcare Revenue Cycle Management Market Trends

AI-native revenue management solutions are now vital as U.S. healthcare providers struggle with increasing administrative complexity and margin pressure. Revenue cycle activities alone cost hospitals more than $160 billion a year, and administrative expenditures make up more than 40% of total hospital spending.

In June 2025, the rapidly expanding enterprise Al healthcare technology firm Commure, which powers providers' next-generation infrastructure, announced that it has obtained $200 million in expansion investment from the Customer Value Fund (CVF) of General Catalyst.

In January 2025, a strategic investment from affiliates of New Mountain Capital, LLC ("New Mountain"), a prominent growth-oriented investment company with around $55 billion in assets under management, was announced by Access Healthcare, a leading revenue cycle management (RCM) platform powered by technology.

Global Healthcare Revenue Cycle Management Market Growth

The global healthcare revenue cycle management market was valued at US$ 136.40 billion in 2023 and is expected to reach US$ 453.47 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.54% between 2024 and 2034.

California:

California has an expansive network of academic health systems, integrated delivery networks and a high volume of inpatient and outpatient care, creating strong demand for advanced RCM solutions. Facilities in California are investing in cloud-native RCM solutions to manage billing across multiple facilities, juggle complicated payers, including Medicare, Medi-Cal and commercial plans, as well as enable growth of ambulatory surgery centres and outpatient care. The regulatory environment in California, which prioritises transparency and patient cost-sharing, is also accelerating RCM adoption.

New York:

New York's healthcare ecosystem, characterised by a high density of hospitals, large physician practices and a variety of commercial payers, creates significant demand for RCM solutions. Providers in New York are facing growing labour costs associated with rising volumes of claim denials, and complicated reimbursement models that include Medicaid/Medicare dual-eligibles, and are therefore investing more in automation, denial analytics and collaborative RCM workstreams. The financial and healthcare concentration of New York leads to intense competition that drives vendors to broaden their services and innovate.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights:

By product type:

In 2024, the integrated product segment led the U.S. healthcare revenue cycle management market, making up the largest portion of both spending and adoption. Integrated products combine registration, eligibility verification, coding, billing, denial management, analytics and collections into a single product offering, thereby allowing healthcare providers to avoid multiple point-solutions, reduce integration cost and improve data continuity. These products provide full visibility into the revenue lifecycle and align better with provider's strategic need to optimise revenue capture throughout the patient journey. Due to their scalability and growing preference for end-to-end workflows, the integrated segment is expected to experience the fastest CAGR of the forecast period.

By function type:

In terms of function type, the claims & denial management segment led the U.S. market in 2024 due to climbing claim rejection rates, increased audit scrutiny and revenue leakage costs. Providers are focusing on denial prevention, appeals automation and analytics to limit lost revenue. The medical coding & billing segment is expected to have the fastest CAGR during the forecast period as automation, AI assisted coding, remote work models and new compliance regulations increase demand for improved coding compliance.

By Deployment Type:

In 2024, the cloud-based deployment segment had the largest market share and is projected to expand at the fastest growth rate. Cloud RCM solutions offer scalability, lower upfront infrastructure costs, easier upgrades, remote access, faster implementations, and easier integration with other cloud health IT platforms for providers. Organizations' adoption of cloud-based RCM is consistent with the overall digital transformation of healthcare, allowing for agile architectures, real-time analytics, and improvement of collaboration across care settings.

By End-User:

In 2024, the U.S. healthcare revenue cycle management market was primarily driven by the physician office segment, since small practices used RCM platforms to improve billing performance, reduce administrative burden, and access functionality once accessible only to larger health systems. However, during the forecast period, the hospitals segment is expected to experience the fastest compound annual growth rate. Hospitals acquire RCM solutions, associated with their high volumes, wide range of service lines, and complex payer landscape, and are increasingly migrating to integrated, cloud-based platforms.

Browse More Insights of Towards Healthcare:

The U.S. laboratory revenue cycle management (RCM) market is valued at USD 14.27 billion in 2024, rising to USD 15.91 billion in 2025, and is projected to reach USD 41.27 billion by 2034, expanding at a CAGR of 11.59% from 2025 to 2034.

The laboratory RCM market is set for strong forward momentum, with revenue expected to scale significantly potentially reaching the hundreds of millions over the 2025 2034 period.

The global AI in healthcare RCM market stands at USD 20.68 billion in 2024, grows to USD 25.7 billion in 2025, and is projected to hit USD 180.33 billion by 2034, reflecting a powerful 24.20% CAGR from 2024 to 2034.

The global telehealth market is valued at USD 153.84 billion in 2025, increasing to USD 191.88 billion in 2026, and is expected to reach USD 1,402.1 billion by 2035, registering a robust 24.73% CAGR between 2026 and 2035.

Meanwhile, the AI in healthcare market is projected to surge from USD 37.98 billion in 2025 to USD 674.19 billion by 2034, advancing at an exceptional 37.66% CAGR.

The global AI in life sciences market is expected to grow from USD 2.25 billion in 2024 to USD 2.71 billion in 2025, and further to USD 14.20 billion by 2034, at a steady 20.21% CAGR.

The global smart healthcare market is set to expand from USD 335.85 billion in 2025 to USD 397.98 billion in 2026, ultimately reaching USD 1,833.7 billion by 2035, growing at a strong 18.5% CAGR.

The global generative AI in life sciences market will grow from USD 302.05 million in 2025 to USD 364.94 million in 2026, and is projected to reach USD 1,657.02 million by 2034, rising at a 20.82% CAGR during the forecast period.

The physical-therapy clinics back-office software market is also gaining momentum worldwide, with revenues expected to rise substantially entering the hundreds of millions between 2025 and 2034.

The chatbots for mental health and therapy market is forecasted to expand from USD 1.77 billion in 2025 to USD 10.16 billion by 2034, growing at a robust 21.3% CAGR.

Recent Developments:

On August 1 2024, R1 RCM, Inc. announced a definitive agreement to be acquired by private equity firms TowerBrook Capital Partners and Clayton, Dubilier & Rice (CD&R) in a deal valuing the company at approximately US$8.9 billion, underlining the strategic value of revenue cycle management firms in the U.S. healthcare ecosystem.

Key Players List:

- Optum (UnitedHealth Group)

- Oracle Cerner

- Epic Systems Corporation

- R1 RCM

- McKesson Corporation

- Waystar

- Athenahealth

- Conifer Health Solutions

- Experian Health

- The SSI Group

- eClinicalWorks

- FinThrive Revenue Systems

- Ensemble Health Partners

- NextGen Healthcare

- AdvantEdge Healthcare Solutions (Health Prime International)

- GeBBS Healthcare Solutions

- Huron Consulting Group

- Cognizant (Trizetto Provider Solutions)

- MedEvolve

- CareCloud

Segments Covered in the Report

By Product Type

- Integrated

- Standalone

By Function Type

- Claims & Denial Management

- Medical Coding & Billing

- Eligibility Verification

- Payment Remittance

- Others

By Deployment Type

- Cloud-based

- On-premise

By End-user

- Physician Office

- Hospitals

- Diagnostic Labs and Ambulatory Surgical Centers

- Others

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6284

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.